The UK is currently moving from the unprecedented into the unknown – trying to adapt to life with a virus we still don’t fully understand; trying to rebuild the economy while preparing for the prospect of future localised flare-ups. Throughout the crisis, the UK’s road transport network has provided some surprising and powerful insights into how the world around us is changing.

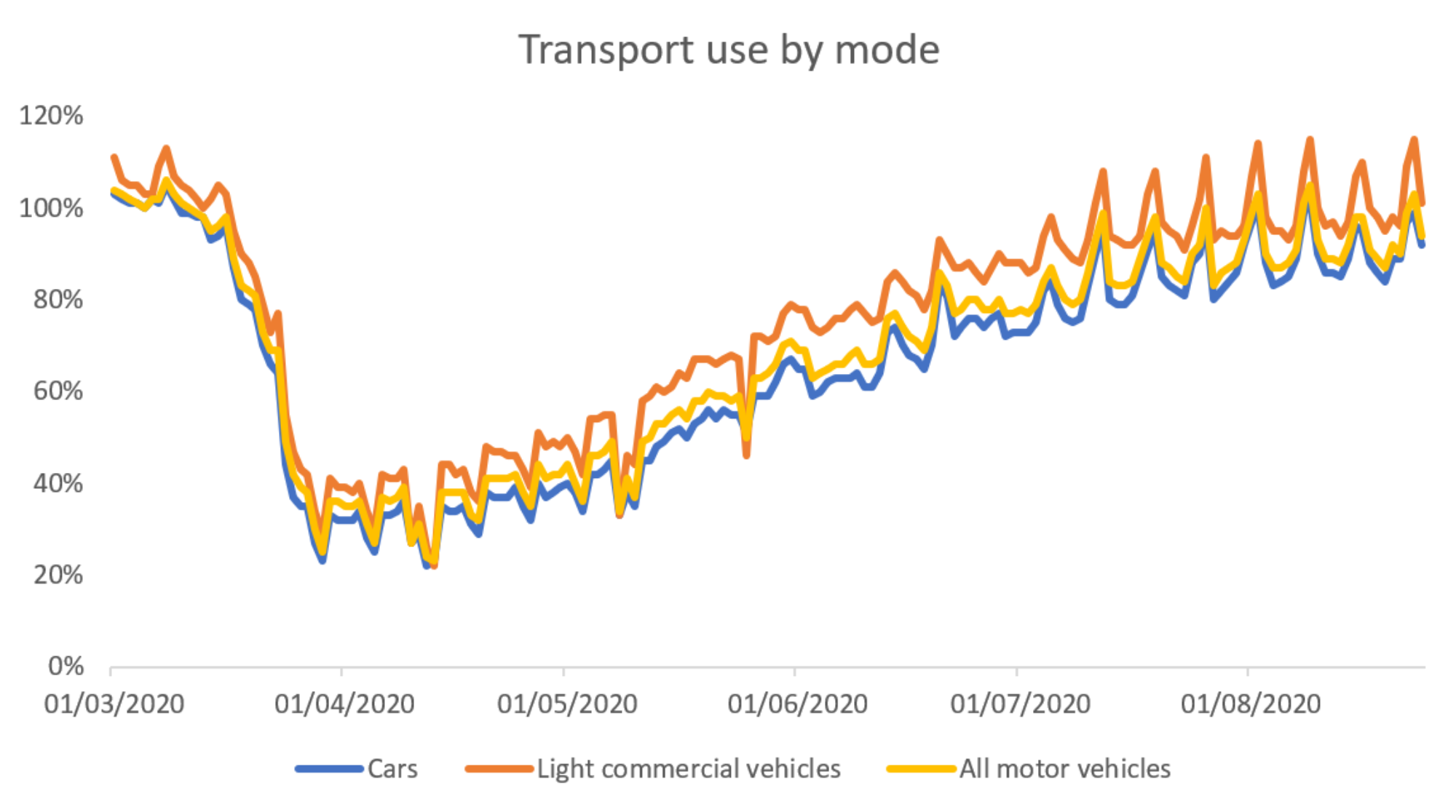

For example, the governments Transport Use by Mode data shows us how overall vehicle usage declined due to home working, shop closures and lockdown restrictions. This reduction in usage has had a corresponding effect on the number of accidents, with some analysts tracking an 80% reduction in collisions at the height of lockdown.

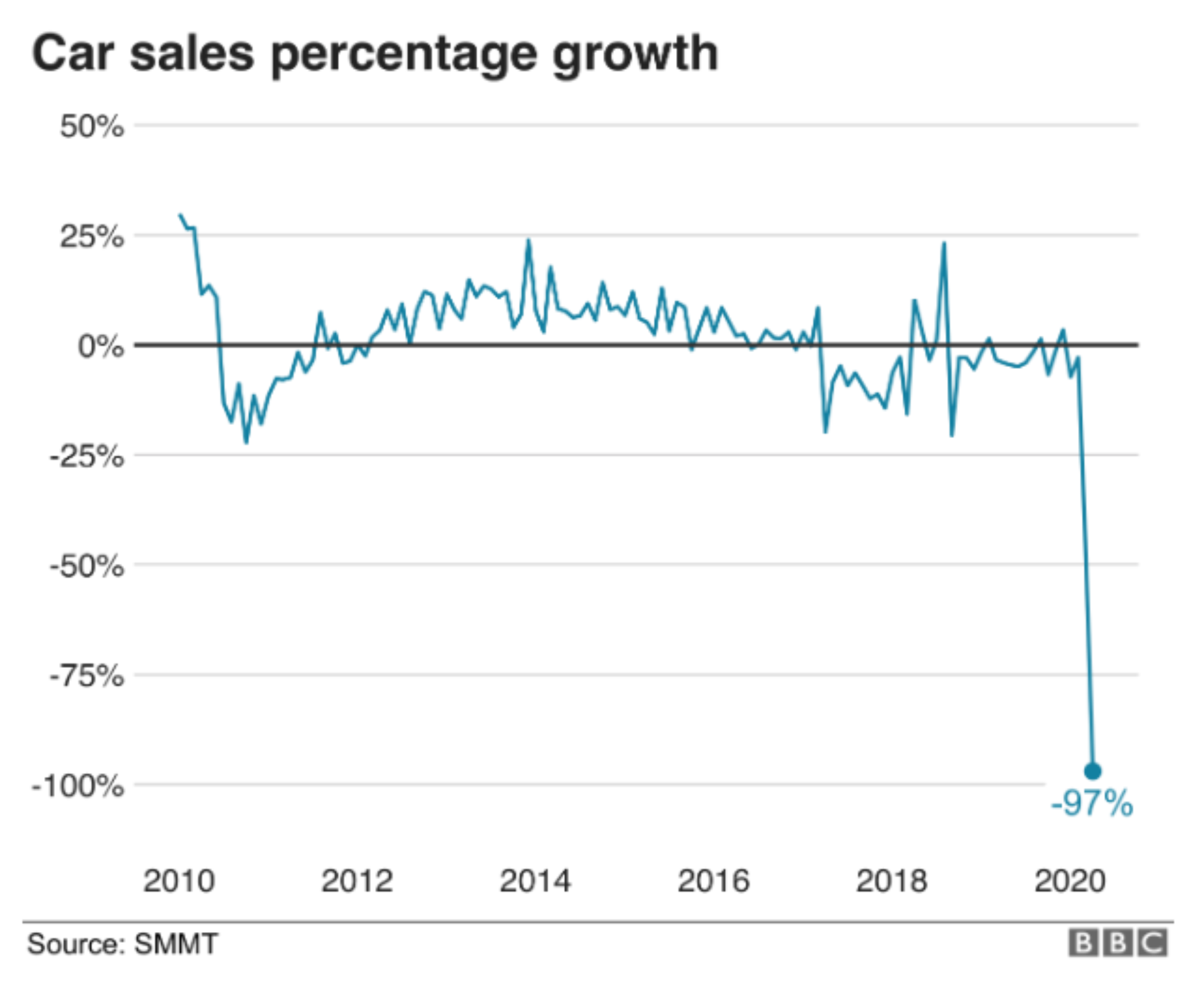

As an industry, we’ve also seen an increase in SORN as occasional drivers decided to take their vehicles off the road – with ERS allowing customers lay-up vehicles at no cost, saving policyholders millions of pounds as they change their or their businesses vehicles usage. Additionally, the new car market has been impacted significantly with a drop off in car sales as high value vehicle purchases were postponed according to the SMMT.

Covid-19 has caused significant changes in road and vehicle usage in the Fleet space. Sectors such as education or tourism have seen vehicle needs reduced as travel ground to a halt and schools closed for most; whereas other sectors, such as healthcare or logistics, have had a greater requirement for their Fleets than ever before as we changed the ways we shopped to rely on home delivery (we’ve probably all seen Amazon and Hermes announcing their plan to hire over 20,000 new drivers to cope with our new delivery demands).

I don’t think anyone can predict what will happen next, and those that do will probably be wrong. But we do know that the last few months have been tough for brokers, businesses and insurers alike. While the UK economy is tentatively reopening, Covid-19 will continue to impact many organisations’ Fleet vehicle needs. At the beginning of the year, ERS Active Underwriter, Martin Hall wrote about the challenges motor premiums would face in 2020. These haven’t been replaced or disappeared, but they have evolved with the impact of Covid-19. These challenges are likely to cause greater disruption to the insurance industry as we all attempt to understand our new normal and what the future will look like as the market attempts to return to long-term, sustainable profitability and support the needs of businesses’ day-to-day fleet operations.

The artificial impact of COVID-19

Pre-Covid-19, rates were hardening because of the combination of increasing reinsurance costs, the impact of the MIB levy and claims inflation – we picked an average increase of around 12% and we’ve seen that come to fruition as insurers with a strong understanding of their market predicted similar rises. However, the reduction in premium as Fleet customers took vehicles off the road throughout the pandemic has increased expense ratios for all insurers resulting in a requirement for insurers to increase in rates simply to cover their costs.

Here’s the juxtaposition, whilst the pressure on insurer’s expense ratios and their expectation that rates will need to continue to rise due to the underlying performance of many books, most customers will see significant improvements in their Fleet portfolio performance due to reduced traffic volumes through the last six months and lower claims frequency. From their point of view, they’ll be expecting significant rate reductions at renewal – especially as insurance is likely one of their top three financial outlays each year.

The insurer and broker’s perspective must be more conservative and considered. Whilst the short-term data may show an improvement in performance, this won’t change the long-term performance of the risk and it’s dangerous to automatically assume that short-term reduction in claims volumes are a consequence of a broader improved performance. The whole industry must maintain the rigour and discipline of its underwriting, to accurately assess the truth behind the data.

Brokers need to take a data driven, long-term view

When underwriting a risk, insurers must consider both the exposure that the risk brings as well as its claims performance over a prolonged period (i.e. 3-5 years). Without understanding this link or focusing on longer-term data sets, it’s impossible to price the risk correctly , particularly when considering fleet, where multiple vehicles, drivers and use cases are involved.

The recent reduction in accidents represents an artificial change in risk because millions of people were mandated to stay at home and avoid non-essential travel. It does not offer an accurate prediction of future claims performance, and it is negligence on the part of an insurer to suggest otherwise. We do not yet know what future UK road usage will look like. Almost all businesses are still feeling their way through this period of uncertainty, with no clear idea as to what awaits them on the other side. How their fleet is deployed could easily change in a month, let alone a year.

Honest conversations with trusted insurers

We’re proud of our heritage as a trusted motor insurance partner to our nationwide broker franchise, we also believe in speaking honestly and setting realistic customer expectations rather than over-promising and under-delivering. We don’t believe that a customer should go from boom to bust when presented with low rates in year one, only to be hit with a huge rate increase in year two. I’ve seen this behaviour from insurers hundreds of times and it’s the broker and their reputation that loses out. At ERS we try to be consistent and honest with our pricing, we’re in it for the long haul and price correctly, so your reputation isn’t impacted, and customers gets a fair, long-term view of their risk.

Right now, we do not believe that any trusted motor insurer will consider lowering customer premiums based solely on recent claims data. It’s important for our brokers to understand this message and to communicate it back to their customers. There will always be a small handful of insurers seeking to mislead and undercut the market for short-term gain – in my experience, that only leads to one thing, upset customers, loss of broker’s reputation and, most likely, losing the risk to another broker.

We are already seeing the number of reported accidents rise steadily, back towards to pre-Covid levels. As the situation continues to evolve, it has never been more important to distinguish between emerging trends which may be permanent, like the growth of eCommerce and home delivery, versus those which are artificial. For the motor market to address its biggest, most longstanding profitability challenges – such as claims inflation, reinsurance costs, levies and fraud – the discipline of underwriting must be maintained at all costs in our response to this latest stage of the Covid-19 pandemic, and the understated claims performance it portrays.

ERS has been writing Fleet risks for over 40 years, providing tailored underwriting on portfolios of anything from five to 500+ vehicles across a variety of sectors. During the lockdown we were quick to recognise that customers’ individual situations were changing rapidly. We responded by offering additional flexibility on our policies – for example, providing laid-up cover for vehicles no longer in use – and we agreed to rebate premiums to many customers where cover was no longer required.

If you would like to know more about our Fleet product and hear from the team directly, you can join on Fleet Webinar or arrange a meeting with the team to discuss any particular risks you may have coming up or simply understand how we can work together. We are happy to help and open for business.